About to buy a commission software? 5 implementation challenges to look out for.

So you’ve decided to level up from spreadsheets and automate your sales commissions. Congratulations! You just ticked a bigggggggggg box in your sales operations maturity checklist.

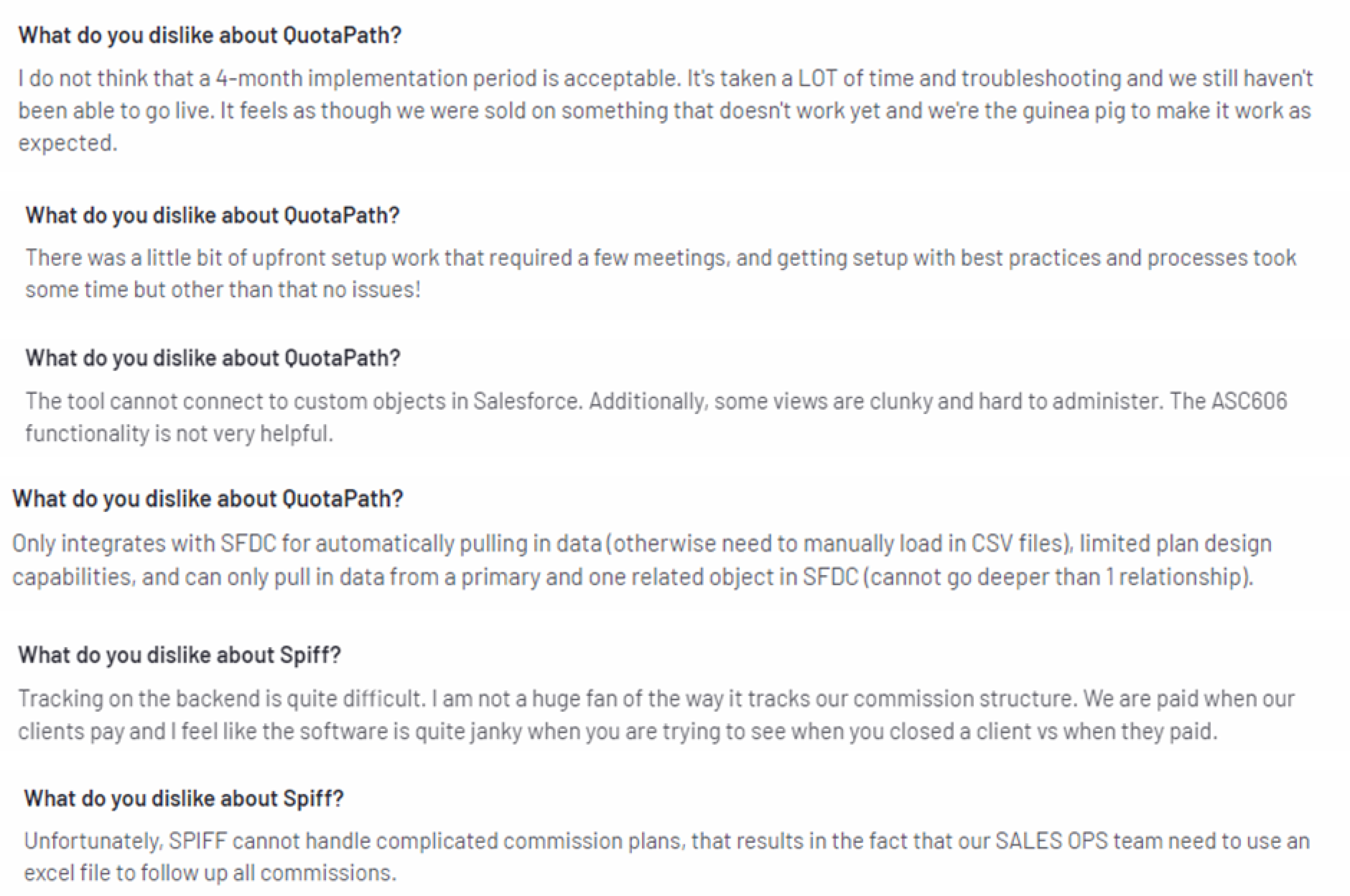

But…(the big hairy but-monster strikes)...months into signing up, you don’t want to sound like the hapless folks below

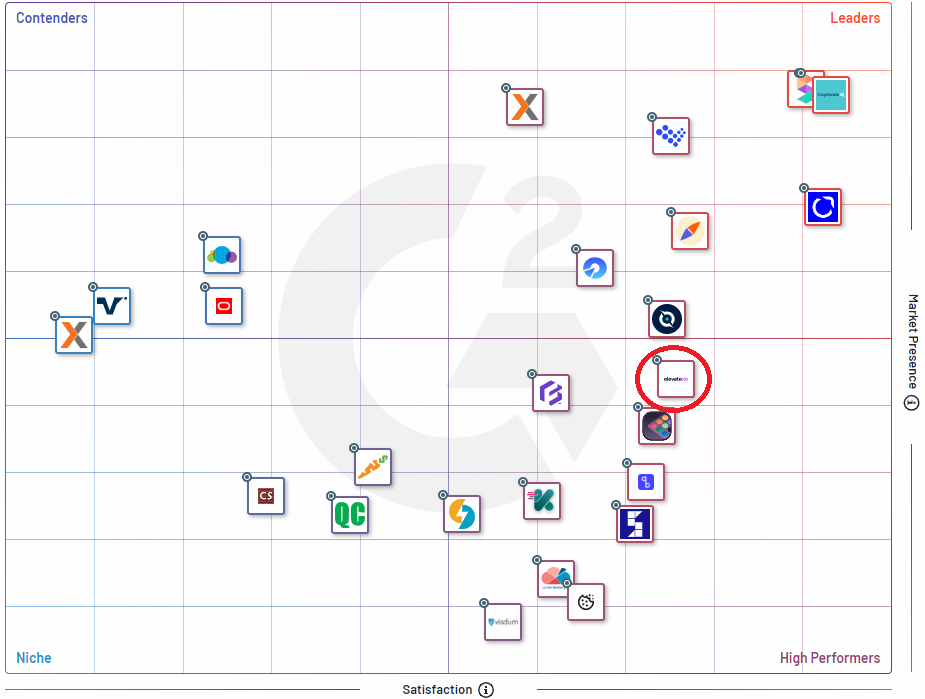

While ElevateHQ is fairly new to the sales commission automation landscape (it launched in 2022), it has now racked 5,000+ implementation hours of hits and a few misses to be at a vantage point from where it could guide future buyers of the many ways in which implementations get f____d.

So without further ado, here is the list of failure nodes that derail most implementations. Keep in mind that we will have this list as a living and breathing document so do not forget to bookmark this page as we refresh our learnings.

We’ll update this page once a month.

**

Let’s start with real examples that we’ve been party to, at ElevateHQ.

A lot of times, the Finance team is the signatory and decision-maker for automating sales commissions. RevOps and SalesOps participate in these discussions but are not the signing authority.

The problem starts when folks from RevOps / SalesOps skip the implementation kick-off call.

While Finance knows the sales commission plan and calculations, RevOps / SalesOps understands how their CRM or Invoicing Software workflows are mapped to deal closures or sales activities that are eligible for commissions.

Without their involvement in the kickoff call, the implementation team is at loggerheads, trying to figure out the custom objects inside Salesforce or Quickbooks that should be a part of the commission formula.

This leads to a lot of back and forth over Slack and emails.

Implementation teams email these questions to Finance which in turn relays these questions to RevOps / SalesOps.

Needless to say, operational slack gathers weight in the process and overall implementation timelines go for a toss.

How to avoid this: Work with the implementation team to build an implementation roadmap, laced with key milestones, from kick-off, testing & validation finally culminating in go-live.

Best practice is to involve at least 1 (if not more) member from the operational ecosystem of Finance, RevOps or SalesOps who knows best about the inner workings of CRM + Invoicing data workflows (if they are not a part of the buying committee already) a fortnight before implementation begins.

If these data workflows are documented, consider sharing the document with your implementation team 7 days before the kick-off call so that they are confidently prepared in advance.

At ElevateHQ, we have pre-built templates and checklists that we share with our prospects well in advance of the kickoff call.

A lot of times, customers share commission plans but are not able to share real commission data with the implementation teams.

This could be due to various reasons (legal approvals, internal VP RevOps / SalesOps approval, data residing in multiple sources) and implementation teams are handicapped to work with dummy data to test commission logic and its accuracy.

While dummy data works well during the staging process, inability to back-test with real data does not lend confidence to the implementation team or the customer to go-live with the software.

For accurate, seamless and fast deployments, we recommend customers to keep real commission data handy and share commission files with the team over the kick-off call.

How to avoid this: Ensure that actual commission data is available to the vendor on day 1. Start gunning for approvals on the day you decide the software you are going ahead with. Depending on the size of your company, it would take you anywhere between 7 - 30 days for approvals in place.

While most customers have a solid commission plan documentation in place, it's rare that these documents include sections around edge cases. For example, most plan documents do not highlight the specific conditions under commissions for a deal are split.

For small companies with <10 reps, manual interventions are par for the course, for you or your implementation specialist (that is, if you get a dedicated implementation specialist at <10 reps).

As the number of reps (and deals) explodes, these one-off deal splitting exercises stop staying one-off and transform into a repeated process, one which needs a template and computation rules.

And thus, the need to automate edge-case rules.

How to avoid this: If you foresee such a circumstance brewing in the near future, communicate with your implementation specialist in advance and (s)he should be able to help you with a personalised template for you.

Doesn’t matter if you or your implementation specialist is coding your commission rules in the software - if the software has a self-serve designer, the implementation will be 3X faster than in a platform without one.

Why?

If the platform has a self-serve designer, non-excel pros would be able to use the user-friendly if-then-else interface to configure rules on their own.

If not, they would have to tap into the time of their seasoned pros who know how to code complex formulas into workbooks embedded inside the software.

These pros come expensive and companies hire only a select few to serve high-ACV accounts (read: enterprises). Naturally, your request will be down low in the pecking order.

The result? Your implementation time goes out of whack.

How to avoid this: Simply ask your vendor if they have a self-serve designer. If their answer is no, we’d recommend you to immediately start looking for a vendor who has an in-built self-serve designer.

If they don’t and you absolutely can’t look for another vendor, start securing an engineer’s time right away. In parallel, communicate with your leadership that implementation might take additional time than budgeted for.

If there is one learning that stands taller than the rest in our implementation hours, it's this - commission plan complexity has no correlation with the number of reps.

For example, ElevateHQ just finished implementation for a 10-rep firm with a commission plan that was subject to 10+ attributes, deal-value being just one of these.

Conversely, ElevateHQ implemented a plan for 50+ reps with a commission plan that was subject to just 2 attributes.

Guess which took longer to implement? ;)

The point I am trying to elicit here is this - irrespective of the size of your firm, you’d need a dedicated implementation specialist. Especially if you have a complex plan.

How to avoid this: Simply ask your vendor if they have Slack or any other form of synchronous support available for implementation and ongoing support.

**

I hope you found this list useful. If you did, spread the word? We are a David in the world of commission automation, competing against Goliaths.

I’d love to hear from you. I am available at akash@elevate.so. I respond to all emails personally <3