When can you pay sales commissions?

Sales commissions can be paid monthly, quarterly, or annually. But deciding which one you should choose depends on a few parameters:

Read on to know more!

We all know that timely commission payouts are the lifeblood of a motivated sales team. Many companies opt for the tried-and-true quarterly approach. But hold on a second!

Before you jump on the quarterly bandwagon, let's take a moment to explore some factors that should be on your radar. Because, trust me, it's not just about convenience.

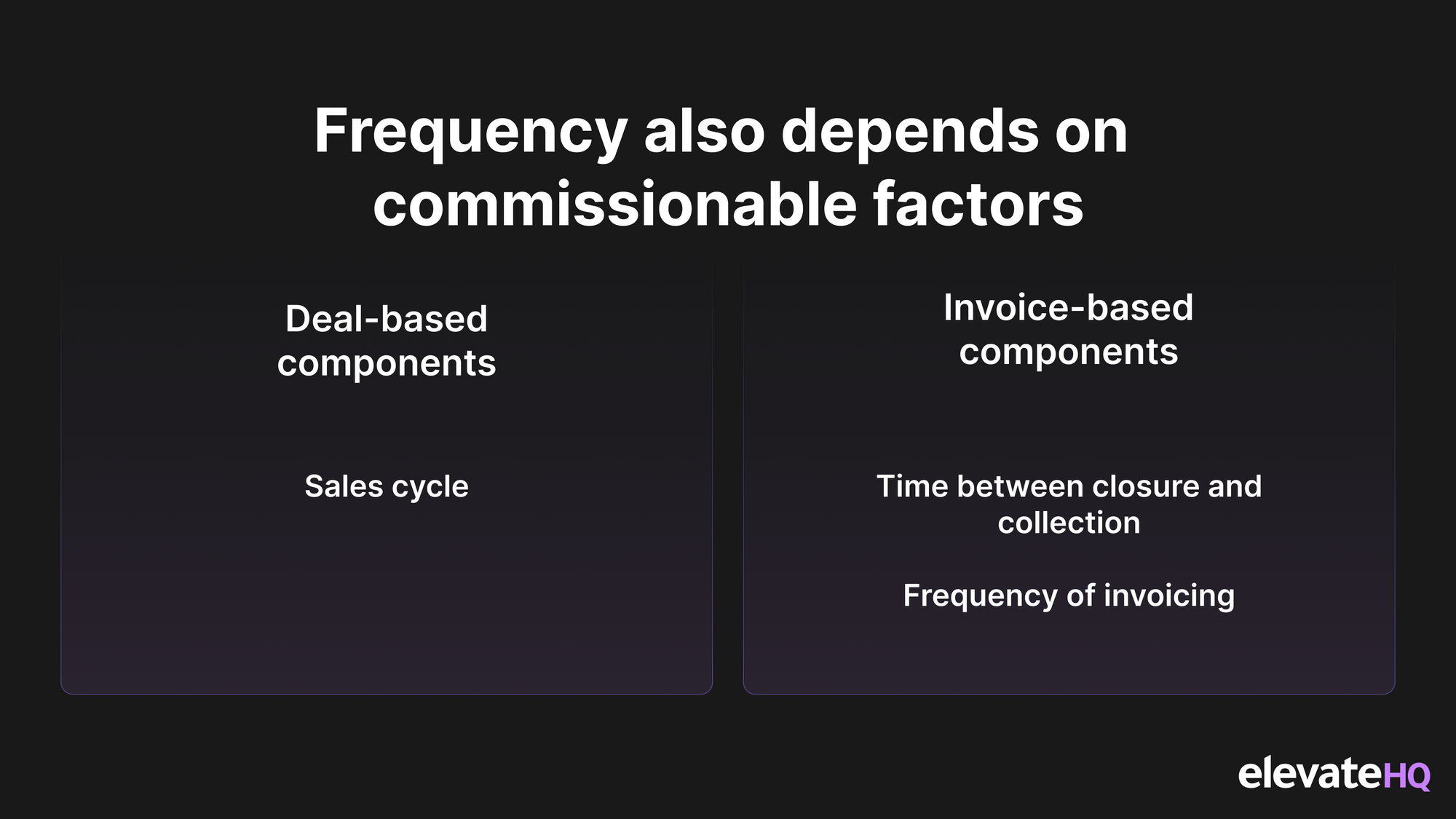

First things first, let’s understand what makes up your commission plan. There are two main types to consider: deal-based and invoice-based components. Stick with me; it's not as complicated as it sounds!

Deal-based components are all about the factors that come into play before you get your hands on that sweet cash. Think deal value, the number of products sold, or even the fancy logos of your clients. These components shape the foundation of your commission plan and can't be ignored.

We also have invoice-based components. They include the number of invoices raised, invoices paid, upfront payments, etc. These add another layer to the commission game.

Let's dive into the nitty-gritty of commission payouts based on deal-based components.

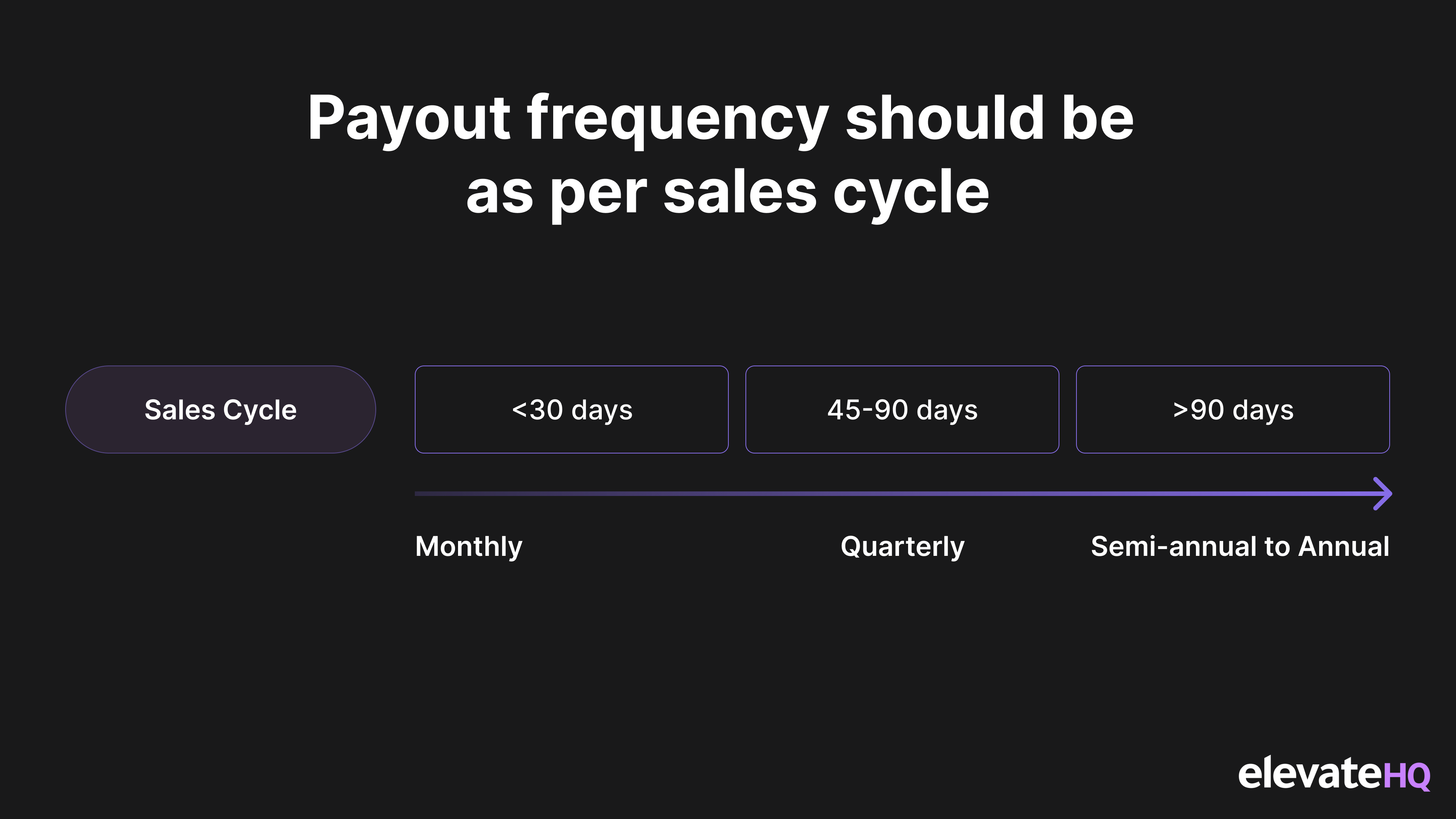

Here's the deal (pun intended): the key factor that should drive your payout frequency is none other than your sales cycle. How long does it take from the first demo to sealing the deal? That's the question.

If your sales cycle is short, it's time to consider monthly payouts. Because a monthly commission schedule keeps your sales rockstars motivated and a consistent cash flow to keep the fire burning. A happy sales rep means more deals closed and cha-ching in the bank.

Now, if your sales cycle falls between 30 and 90 days, it's time to bring out the big guns – quarterly commission payouts. This timeframe strikes a balance. It gives you enough time to tally up the closed deals and revenue, making sure your reps are rewarded for their hard work without making them wait forever.

However, some companies have shaken things up by trying out bi-weekly commission payments. This strategy is prevalent in industries with lightning-fast sales cycles or many transactions. It's like a turbo boost for motivation and financial stability, giving your reps a steady flow of income to keep them on their A-game.

Remember, understanding the length of your sales cycle is key to finding that perfect payout frequency. When you sync your commission payments with your sales cycle, you're not just keeping your sales team fired up but also setting the stage for a win-win situation.

So, before you settle on a payout schedule, take a step back, grab a cup of coffee, and give these factors a good ponder. Understanding the components that make up your commission plan is like having the secret sauce for the perfect payout frequency.

When your commission plan includes invoice-based components, there's an extra factor you need to keep in mind: the time it takes to collect those invoices.

Yep, it's not just about closing deals and raising invoices; you have to consider how long it takes to get that sweet moolah in your hands.

Now, there are different kinds of invoice components. If your commissions are based on invoices raised alone, you can breathe easy – the collection time doesn't matter much. But it's time to pay attention if you've got factors tied to invoice collection.

Picture this: if your deal closure, invoice raising, and invoice collection typically wrap up within 90 days, it's a good idea to go for quarterly commission payouts. This way, you give yourself enough time to collect those payments before dishing out the well-deserved commissions.

But if it takes longer than 90 days to get those invoices settled, think bigger. Consider semi-annual or even annual commission payouts. This longer timeframe lets you gather all those outstanding payments before splurging on commissions.

Here's the kicker: if you're in a business where invoice collection happens faster than you can say "commission," you're in luck! Think subscription-based companies where payments roll in like clockwork. In these cases, monthly commission payouts can be your go-to choice.

By keeping an eye on the time between sales and invoice collection, you'll find the perfect rhythm for commission payout frequency. This keeps your sales reps pumped, financially secure, and ready to rock the sales game. So, let those invoices flow, and let the commissions rain down!

In conclusion, finding the right frequency is a balancing act when it comes to commission payouts. It's about keeping your sales team motivated, ensuring a steady cash flow, and aligning with the realities of your business. Whether you're focusing on deal-based or invoice-based components, understanding your sales cycle and the time it takes for invoice collection is crucial.

There's no one-size-fits-all approach, from monthly excitement to quarterly rewards or even experimenting with bi-weekly payouts. So, grab your calculator, analyze your components, and make a payout plan that energizes your sales reps, motivates them, and prepares them to conquer the sales world. Remember, everyone wins when the commissions roll in at just the right time!